How to Generate Passive Income Effortlessly in 2023: Separating Myth from Reality

The allure of passive income has always captivated individuals seeking financial freedom and a more relaxed lifestyle. In 2023, the landscape of earning money is evolving rapidly, offering a myriad of opportunities to explore the possibility of making money with minimal effort. While the concept of making money doing nothing might seem too good to be true, this article delves into various strategies that can help you generate passive income streams and work towards a more secure financial future.

Understanding Passive Income

In a world where the traditional 9-to-5 grind is redefined, passive income is a beacon of financial freedom. But what exactly is passive income, and how can you tap into its potential in 2023? Let’s delve deeper into the concept and its various forms.

Defining passive income and its types

Passive income refers to earnings generated with little to no ongoing effort after the initial setup. Common types of passive income include rental income, dividends from stocks, and royalties from creative works. It’s important to note that even though the income might become passive over time, the initial effort and investment are crucial.

Debunking misconceptions about making money with zero effort

Contrary to popular belief, generating passive income doesn’t mean you can completely avoid putting in any effort. Passive income streams often require upfront work, whether it’s building an online business, investing in real estate, or creating digital products. However, the goal is to minimize the ongoing effort once the income stream is established.

Importance of initial effort and investment

Every successful passive income venture requires an initial investment, whether it’s financial, time, or expertise. Real estate, for instance, demands capital for property acquisition, and online businesses require time to develop a customer base. A strong foundation is crucial for a sustainable and genuinely passive income source.

Leveraging Investment Opportunities

Regarding passive income, smart investments can be a reliable path toward financial stability and freedom. Here, we explore several investment avenues that allow you to let your money work for you in 2023.

1. Exploring dividend stocks and their potential

Dividend stocks offer shareholders a portion of a company’s earnings regularly. You can create a consistent income stream by strategically investing in dividend-paying companies. Research and choose companies with a history of stable dividends to maximize potential returns.

2. The rise of robo-advisors for automated investing

Robo-advisors are automated platforms that manage your investments based on your risk tolerance and financial goals. These tools use algorithms to rebalance your portfolio and optimize returns, requiring minimal intervention from your end.

3. Real estate crowdfunding as a source of passive income

Real estate crowdfunding platforms allow you to invest in real estate projects with a relatively small amount of capital. This eliminates the need to manage properties yourself while still reaping the benefits of rental income and property appreciation.

The World of Online Businesses

In the digital age, the internet has opened up a realm of possibilities for generating passive income through online businesses. Let’s explore some of these opportunities that allow you to monetize your interests and skills without being tethered to a physical location.

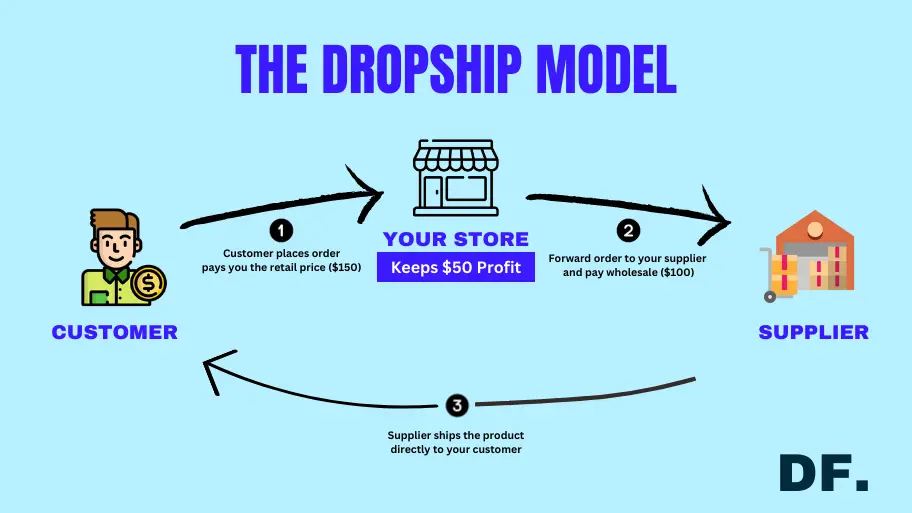

1. Dropshipping: Myth vs. Reality

Dropshipping entails the sale of products via an online store without the need to maintain inventory. While it can be a source of passive income, it’s essential to manage customer service, order fulfillment, and marketing effectively for sustained success.

When it comes to dropshipping, the best suppliers can vary based on your niche, location, and specific business needs. Here are some popular dropshipping suppliers that have gained positive reputations:

- SaleHoo: A directory of verified suppliers and wholesalers, SaleHoo can help you find reliable sources for your dropshipping business.

- AliExpress: A well-known platform that connects dropshippers with suppliers primarily based in China. It offers a wide range of products across various categories.

- Oberlo: An app integrated with Shopify, Oberlo provides access to a wide range of products from AliExpress, making it easy to import products to your store.

- Spocket: Focused on connecting dropshippers with suppliers from Europe and the United States, Spocket offers faster shipping times and quality products.

- Printful: Specializing in custom printing and embroidery, Printful is ideal for dropshipping custom-designed apparel, accessories, and home decor items.

- Modalyst: Offering a curated selection of unique and trendy products, Modalyst connects dropshippers with high-quality suppliers.

- Wholesale2B: This platform offers integration with various e-commerce platforms and provides access to a wide range of dropshipping products.

- Worldwide Brands: Known for its extensive directory of certified wholesalers and dropshippers, Worldwide Brands can help you find reliable suppliers.

- Doba: Doba aggregates products from various suppliers, making it easier to find products and manage orders in one place.

- Dropified: Similar to Oberlo, Dropified helps automate the process of importing products from various suppliers to your Shopify store.

Remember that the “best” supplier for you depends on factors such as the products you intend to sell, the regions you’re targeting, shipping times, product quality, and supplier reliability. It’s recommended to thoroughly research and test suppliers to find the ones that align with your business goals and customer expectations.

2. Affiliate marketing and the power of referral income

Affiliate marketing is a dynamic and mutually beneficial business model that connects individuals or entities, known as affiliates, with companies offering products or services. In this arrangement, affiliates promote the company’s offerings through various digital channels, and in return, they earn commissions for every sale, lead, or other predefined action generated through their promotional efforts.

At its core, affiliate marketing revolves around the concept of referral-based income. Affiliates leverage their online platforms, such as blogs, websites, social media profiles, and YouTube channels, to share information about products or services they believe in. They incorporate unique affiliate links within their content, which lead potential customers to the company’s website. When a person follows an affiliate link and makes a purchase or completes a desired action, the affiliate receives a percentage of the sale value or a fixed commission as a reward.

This approach benefits all parties involved. Companies gain exposure and new customers without upfront advertising costs, while affiliates earn a passive income by effectively leveraging their online influence. Affiliate marketing’s flexibility and accessibility have made it a prominent strategy in the digital landscape, enabling individuals to monetize their online presence and companies to expand their reach through a network of enthusiastic promoters.

Benefits of Affiliate Marketing:- Passive Income Stream: One of the most appealing aspects of affiliate marketing is the potential for passive income. Once an affiliate link is placed within a piece of content, it generates revenue as long as people interact with it and make purchases.

- Low Barrier to Entry: Affiliate marketing doesn’t demand a significant upfront investment. Anyone with a digital platform and an audience, such as a blog, website, social media profile, or YouTube channel, can become an affiliate and start earning commissions.

- Diverse Product Range: Affiliates can promote various products and services across various niches. This versatility allows them to cater to their audience’s interests and preferences.

- No Product Creation: Unlike running an e-commerce store or creating a product, affiliates don’t need to deal with inventory management, shipping logistics, or customer service. This reduces operational complexities and allows affiliates to focus on promotion.

- Performance-Based Model: The success of affiliate marketing relies on performance. Affiliates are motivated to deliver results as their earnings are directly tied to their promotional efforts and the resulting conversions.

- Global Reach: The internet has enabled affiliates to reach a global audience, breaking down geographical barriers and expanding the potential customer base.

- Niche Selection: Affiliates should choose a niche they are passionate about and have expertise in. This allows for authentic and informed content creation.

- Quality Content: Creating valuable and engaging content is crucial for attracting and retaining an audience. High-quality content builds trust and encourages visitors to click on affiliate links.

- Transparency and Trust: Disclosing affiliate relationships is essential for maintaining credibility and trust with the audience. Transparency about potential commissions fosters openness.

- Strategic Promotion: Affiliates need to strategically place affiliate links where they will naturally fit within the content and resonate with the audience’s needs.

- Continuous Learning: The digital landscape is constantly evolving. Successful affiliates stay updated with industry trends, digital marketing strategies, and new promotional techniques.

In conclusion, affiliate marketing empowers individuals and businesses to tap into a vast revenue stream through the strategic promotion of other companies’ products and services. This win-win collaboration has transformed the way marketing is approached in the digital age, offering a viable income source and the potential for sustained growth. By harnessing the power of referral income, affiliates can monetize their digital presence while providing valuable recommendations to their audience.

3. Creating and selling digital products or courses

Share your expertise by creating digital products or online courses. Once developed, these products can be sold repeatedly without constant effort. Platforms like Udemy and Teachable simplify the process of hosting and selling online courses.

The Rise of Digital Products and Online Courses:The advent of the internet has democratized education, enabling anyone with valuable knowledge to create and sell educational content. Whether you’re a seasoned professional, a hobbyist, or an enthusiast with specialized skills, the digital realm offers a platform to share your insights with the world.

Types of Digital Products:- Ebooks and Guides: Ebooks are a versatile form of digital content that can cover a wide range of topics. From comprehensive guides to niche-specific tutorials, ebooks provide a platform for in-depth exploration of subjects.

- Templates and Resources: Digital templates, such as design templates, budget planners, and resume layouts, cater to practical needs and save time for users. Providing ready-to-use resources adds value and convenience.

- Printables: These include downloadable art prints, planners, worksheets, and more. Printables are popular for both personal use and home decor.

- Audio Products: Podcasts, audio courses, and guided meditation sessions are examples of digital products that engage the auditory senses.

- Video Content: Video tutorials, training series, and skill development courses are highly engaging and can cover a wide range of topics, from cooking to coding.

Online courses offer a comprehensive way to share in-depth knowledge and skills with learners. With platforms like Udemy, Teachable, and Thinkific, creating and hosting courses has become streamlined. These platforms provide tools for structuring content, creating assessments, managing enrollment, and even processing payments.

Steps to Successful Digital Product or Course Creation:- Choose Your Niche: Identify a subject where you possess the expertise and that aligns with audience demand.

- Plan Your Content: Outline the curriculum or content structure. Ensure it is logical, engaging, and caters to various learning styles.

- Content Creation: Develop content in your preferred format—text, video, audio, or a combination. Keep it engaging and structured.

- Interactive Elements: Incorporate quizzes, assignments, and discussions to enhance learner engagement.

- Production Quality: Maintain a professional production standard to enhance the perceived value of your product or course.

- Branding and Design: Create an appealing visual identity for your digital product or course to establish credibility.

- Pricing Strategy: Research competitors and determine a fair pricing model that reflects the value you provide.

- Marketing and Promotion: Utilize social media, email marketing, and other digital channels to promote your product or course.

- Engage with Your Audience: Encourage feedback and interaction to continually improve your offerings.

- Scalable Income: Once created, digital products and courses can be sold repeatedly, generating passive income.

- Global Reach: The internet enables you to reach a worldwide audience, breaking down geographical barriers.

- Expert Status: Sharing your expertise positions you as a credible authority in your field.

- Flexibility: You can create and manage your content on your schedule, offering a high degree of flexibility.

- Diverse Revenue Streams: You can combine different types of digital products and courses for multiple income sources.

In conclusion, the digital era has opened up a world of possibilities for individuals to share their knowledge and earn income through digital products and online courses. By carefully crafting valuable content and leveraging user-friendly platforms, creators can tap into the growing demand for self-paced learning experiences, providing value to learners while building a sustainable income stream.

Rental Income and Real Estate

Real estate has long been a cornerstone of passive income strategies. Owning properties can provide a steady stream of income while potentially benefiting from property appreciation over time. However, it’s essential to grasp the dynamics of rental income and understand both the advantages and challenges it presents.

Pros and cons of owning rental properties

Owning rental properties can provide a steady stream of income, but it comes with responsibilities such as property maintenance and tenant management. Consider the local real estate market and potential risks before investing.

Property management services for hands-off rental income

If you want to enjoy rental income without the hands-on work, property management services can handle tenant communication, repairs, and other tasks for a percentage of the rent.

The potential of short-term rentals in the sharing economy

Platforms like Airbnb allow you to rent out your property for short durations, potentially earning more than traditional long-term rentals. However, be prepared for fluctuating occupancy rates and the need for consistent upkeep.

Writing and Creative Arts

For those with a knack for creativity, the digital landscape offers a multitude of opportunities to turn your passion into a source of passive income. From sharing your expertise through self-published books to capitalizing on your artistic talents, let’s explore how the world of writing and creative arts can pave the way for passive earnings.

1. Self-publishing books and ebooks

If you’re an author, self-publishing platforms like Amazon Kindle Direct Publishing offer a way to earn royalties from your books without dealing with traditional publishing houses.

2. Earning royalties from music and artwork

Digital platforms like Spotify and Etsy enable musicians and artists to earn ongoing royalties from their creative works, turning their passion into a source of income.

3. Print on demand: Designing and selling custom products

Print-on-demand services let you create custom designs for products like T-shirts, mugs, and phone cases. The service handles production and shipping, leaving you with a share of the profit.

The Role of Technology and Automation

In the fast-paced digital era, technology has emerged as a key facilitator in realizing the dream of generating passive income. From developing mobile apps to establishing a successful online presence, let’s delve into how technology and automation can reshape the way you earn money with minimal effort.

1. Building and monetizing mobile apps

If you have programming skills, creating a mobile app can be a lucrative venture. In-app purchases, advertisements, and premium versions can provide ongoing revenue.

2. Creating a successful YouTube channel

YouTube offers the opportunity to earn money through ad revenue, sponsored content, and merchandise sales. Consistently creating valuable and engaging content is key to building a successful channel.

3. Membership websites and exclusive content

Launch a membership website where subscribers pay a fee to access exclusive content or resources. This can include articles, videos, webinars, or downloadable materials.

Peer-to-Peer Lending and Crowdfunding

In the realm of finance, peer-to-peer lending and crowdfunding have emerged as innovative avenues for both investors and entrepreneurs to tap into passive income streams. These platforms empower individuals to participate in ventures and projects, shaping the landscape of modern investment.

Understanding peer-to-peer lending platforms

Peer-to-peer lending platforms connect borrowers with individual lenders, allowing you to earn interest on the money you lend. Assess the risk factors and diversify your lending portfolio for a balanced approach.

Exploring crowdfunding for startups and projects

Crowdfunding platforms like Kickstarter and Indiegogo let you invest in promising startups or contribute to creative projects in exchange for rewards. Research thoroughly before backing any project.

Evaluating the risks and rewards of these platforms

While these platforms offer opportunities for passive income, they also come with risks. Be cautious, do thorough research, and diversify your investments to mitigate potential losses.

Navigating the Risks and Challenges

While the allure of passive income is undeniable, it’s essential to approach it with a discerning eye and a thorough understanding of potential risks. From distinguishing genuine opportunities to maintaining a balanced approach, navigating the challenges is crucial for a successful passive income journey.

Recognizing scams and fraudulent schemes

As the popularity of passive income grows, so does the number of scams and fraudulent schemes. Be vigilant and research any opportunity thoroughly before committing.

Balancing risk and reward in pursuit of passive income

All investment opportunities come with varying degrees of risk. Consider your risk tolerance, financial goals, and potential rewards before investing your time and money.

The necessity of ongoing monitoring and adjustments

Even after setting up a passive income stream, regular monitoring and adjustments are essential. Market conditions, trends, and customer preferences change, requiring you to adapt to maintain your income.

Achieving a Balanced Lifestyle

The pursuit of passive income isn’t solely about accumulating wealth; it’s about creating a life of balance, freedom, and fulfillment. As you venture into the realm of passive income, consider how it can align with your personal and financial aspirations.

Redefining the concept of “doing nothing”

While the term “doing nothing” might be a bit misleading, the goal is to achieve a balance between effort and relaxation. Passive income provides the opportunity to enjoy life without being tied to a traditional 9-to-5 job.

The importance of work-life balance

Focusing solely on generating passive income can lead to burnout. It’s crucial to maintain a healthy work-life balance, nurturing relationships, and personal well-being.

Ensuring financial security and peace of mind

The ultimate aim of pursuing passive income is to achieve financial security and peace of mind. By diversifying your income sources and planning for the long term, you can create a more stable financial future.

Exploring Passive Income: Your Questions Answered

Is passive income truly achievable?

Yes, but it requires upfront effort and ongoing monitoring. The term “passive” refers to reduced effort over time, not the absence of effort altogether.

What’s the best passive income source?

The best source depends on your skills, interests, and risk tolerance. Explore options that align with your strengths and financial goals.

Are there risks involved with passive income strategies?

Yes, every investment comes with risks. Research thoroughly, diversify your investments, and be prepared to adapt to changing circumstances.

How can I start with passive income in 2023?

Start by assessing your skills and interests. Research various passive income strategies, choose one that resonates with you and be prepared to invest time and effort initially.

Conclusion: Building a Future with Passive Income

In conclusion, generating passive income in 2023 is not about doing nothing but rather about strategically investing your time, skills, and resources to create sustainable income streams. Whether through investments, online businesses, real estate, or creative endeavors, the opportunities are diverse and exciting. By understanding the importance of initial effort, navigating potential challenges, and maintaining a healthy balance, you can work towards a future where financial security and a relaxed lifestyle go hand in hand.

FAQ

Q1: Can I generate passive income without any upfront investment?

A: While some methods may require minimal upfront investment, such as affiliate marketing or creating digital products, most passive income streams do involve some form of initial investment.

Q2: How long does it take to start seeing results with passive income?

A: The timeline varies depending on the chosen method and your efforts. Some methods might yield results within a few months, while others could take years to become fully passive.

Q3: Is passive income taxable?

A: Yes, passive income is typically liable to be taxed. It’s advisable to seek guidance from a tax professional to gain insights into the tax consequences associated with your specific sources of income.

Q4: Can I rely solely on passive income and quit my regular job?

A: While it’s possible, it’s recommended to have a diversified income portfolio. Relying solely on passive income can be risky, especially in the early stages.

Q5: How do I avoid falling for passive income scams?

A: Be cautious of any opportunity that promises extremely high returns with minimal effort. Research thoroughly, check for reviews, and consult with trusted financial advisors.

Remember, the journey toward passive income requires dedication, smart decision-making, and ongoing learning. With the right approach, you can enjoy the benefits of financial freedom and a more balanced lifestyle in 2023 and beyond.